Introduction

Taxation function simplifies tax management for your organization. It allows you to set up and maintain chart of accounts, manage tax codes and rates, generate tax reports and returns, including VAT/GST and sales tax returns, and prepare for filing in an efficient manner.

This includes recording debits and credits in the general ledger, managing receipts and payments, creating journals, and maintaining a chart of accounts. It also provides users with the ability to generate financial snapshots for better insight into their business.

Features

Tax Group & Rates

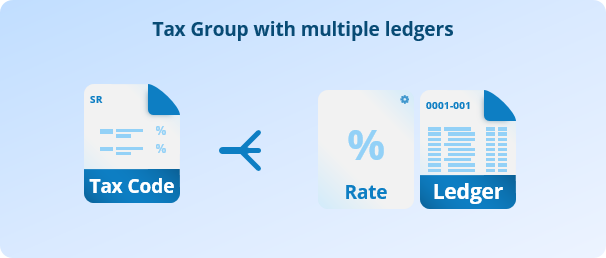

Tax group, also commonly known as a tax code, is a selectable code that can be applied to invoices to indicate the taxes that apply to the items or services being purchased. Tax groups are used to group multiple tax rates that apply to a particular item or service.

Tax Rates

A Tax Rate is a percentage or fixed amount that is applied to a specific item or service. It is a subsidiary of a Tax Group and represents an individual ledger on the chart of accounts.

Tax rates are typically set by government or other tax authorities and can vary depending on the type of item or service being purchased, the location of the sale, and other factors.

In Cloudby, the Tax Rate is date based, which means you can set new rates with the effective date ahead of time, this allows for taxes amount to be calculated correctly based on the invoice date. This ensures that businesses are applying the correct taxes and staying compliant with tax laws and regulations.

Processes

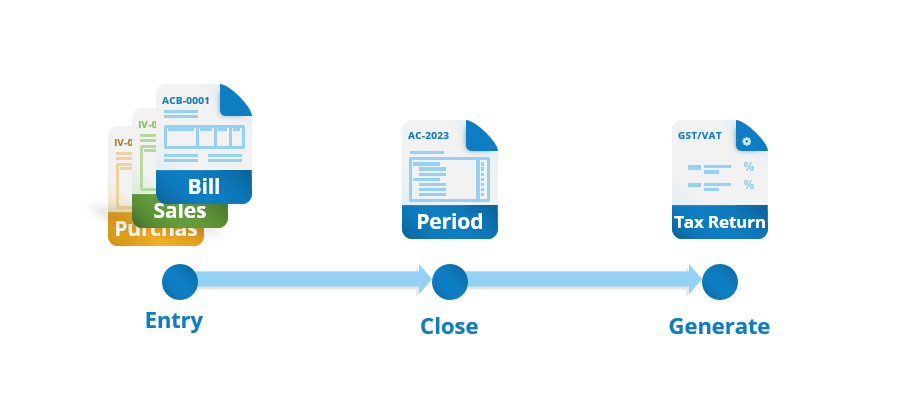

Generating Tax Returns

Coming soon

Coming soon

Learn More

Tours

- Bookkeeping & Automation

- Tips to do thing and that

Tutorials

- Bookkeeping & Automation

- Tips to do thing and that